Get familiar with The Nuts and bolts of Obligation Settlement

Do you have $10,000 or more in

charge card or other debt without collateral? Is it safe to say that you are

scarcely making your base regularly scheduled installments? Or on the other

hand, would you say you are getting calls and letters from lenders that your

installments are past due? Assuming you have addressed yes to any of these

inquiries, figure out how obligation repayment empowers you to make one

regularly scheduled installment, and to escape obligation in a more limited

timeframe than you would on the off chance that you kept on paying the base

month to month adjusts.

Assume that you currently have

$25,000 of uncollateralized debt with five Mastercard organizations at a mixed

loan cost of 23%. By going on with a base regularly scheduled installment of

around $729, it will take you 36 years and 9 months to escape obligation.

What's more, what's far and away more terrible, you will pay a sum of

$47,268.00 in interest, notwithstanding the $25,000 that you as of now owe.

That is a fantastic complete of $72,268.00! So this present time may be the

opportunity to stop this damaging cycle and get the assist you with requiring

from a trusted and FTC-agreeable reimbursement organization.

Before we continue with

obligation repayment (additionally alluded to as obligation goal and obligation

arrangement), we should momentarily check out at chapter 11 and obligation

combination, two other conventional approaches to paying off past commitments.

New liquidation regulations have made it more hard for customers to become

obligation free than previously. Obligation union decreases financing costs and

wipes out late expenses and over-the-limit charges. Notwithstanding, it doesn't

decrease the equilibriums that are owed to banks.

In the first place, new FTC

guidelines deny obligation settlement organizations from charging forthright

expenses before they start working with shoppers. A FTC-agreeable organization

gives potential clients a free, no commitment obligation examination, which

ought to incorporate a reimbursement investment funds gauge.

With a reimbursement program,

moderators speak with creditor(s) for your benefit to settle your obligations

to diminished and "consented to" sums. Nonetheless, a reimbursement

organization can't "force" a bank or some other monetary foundation

to haggle with them. In some cases, a goal can't be reached. Notwithstanding,

many banks and monetary organizations will arrange, trying to determine the

obligation issue.

A reimbursement organization that

is consistent with the Bureaucratic Exchange Commission, an autonomous office

of the US government, can't make any guarantees about paying off your

obligation by half, 60%, or makes no difference either way. Results shift from

one individual to another. Notwithstanding, a dependable firm will give their

very best for set aside you however much cash as could be expected. A main

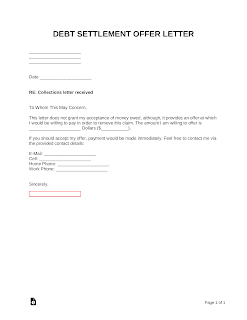

obligation goal organization has this assertion on their site: "We or your

appointed nearby lawful portrayal will do everything ... to set aside you

however much cash as could reasonably be expected. Audit past settlement

letters to find out about how we have had the option to arrange settlements

with loan bosses previously."

Despite the fact that you have

signed up for a repayment program, calls and letters from your leasers could

proceed. A FTC-consistent organization advises every one of your banks recorded

as a hard copy that you have signed up for their program. Nonetheless,

investment paying off debtors repayment doesn't be guaranteed to stop

"legal assortment exercises." Numerous reimbursement clients report

that calls and letters from lenders and assortment organizations in all

actuality do stop or diminish whenever they have looked for obligation

alleviation.

At last, a FTC-agreeable

organization ought to let you know that you can never again bank (checking,

currency market, and so on) with any of the Mastercard organizations that are

important for your settlement. The bank could hold onto your resources as their

very own component assortment action.

Obligation settlement has turned

out surprisingly for huge number of individuals throughout the long term. Yet,

similar to anything beneficial, individual responsibility is required. For

instance, you could need to change a portion of your spending and individual propensities.

How? Make your financial plan your pal, get a less expensive phone plan, quit

smoking, use devotion cards at pharmacies and grocery stores, purchase store

brands rather than name brands, change to satellite TV, cut out the everyday

latte, watch bank charges, etc.

For More Info: -Collection Defense Attorney mn

fair

debt collection practices act mn

Comments

Post a Comment